Reference

OpenAI's Answer

Liquidity-adjusted Value at Risk (LVaR) incorporates aspects that traditional Value at Risk (VaR) does not, primarily by accounting for liquidity risk. Here's a summary of what LVaR includes that traditional VaR does not:

-

Liquidity Risk: Traditional VaR assumes that markets are perfectly liquid, meaning that any quantity of an asset can be bought or sold without affecting the market price. LVaR, on the other hand, incorporates liquidity risk, which is the risk that an asset cannot be traded quickly enough in the market to prevent a financial loss source.

-

Bid-Ask Spread: LVaR models adjust the VaR calculation by including the bid-ask spread of a security, which traditional VaR models typically ignore. This spread can significantly affect the ability to realize the expected cash flows from trading source.

-

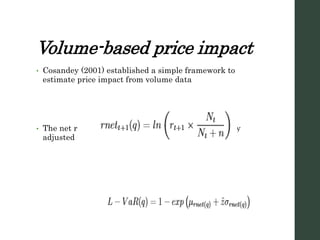

Market Impact and Order Size: LVaR considers the impact of large trades on market prices, accounting for the fact that trading large volumes can move the market price unfavorably against the trader's position source.

By incorporating these factors, LVaR provides a more accurate and realistic assessment of risk for trading portfolios, especially in volatile or illiquid markets.

Follow Up

Related

How is elevation adjusted on the AK-47's front sight in the field?

Which car brands were specifically mentioned as adjusting their emission settings in Germany?

How much was paid for the land from Mount Pleasant Cemetery for the road expansion, adjusted for inf

How does Ting Mobile's billing model adjust based on customer usage?