Reference

OpenAI's Answer

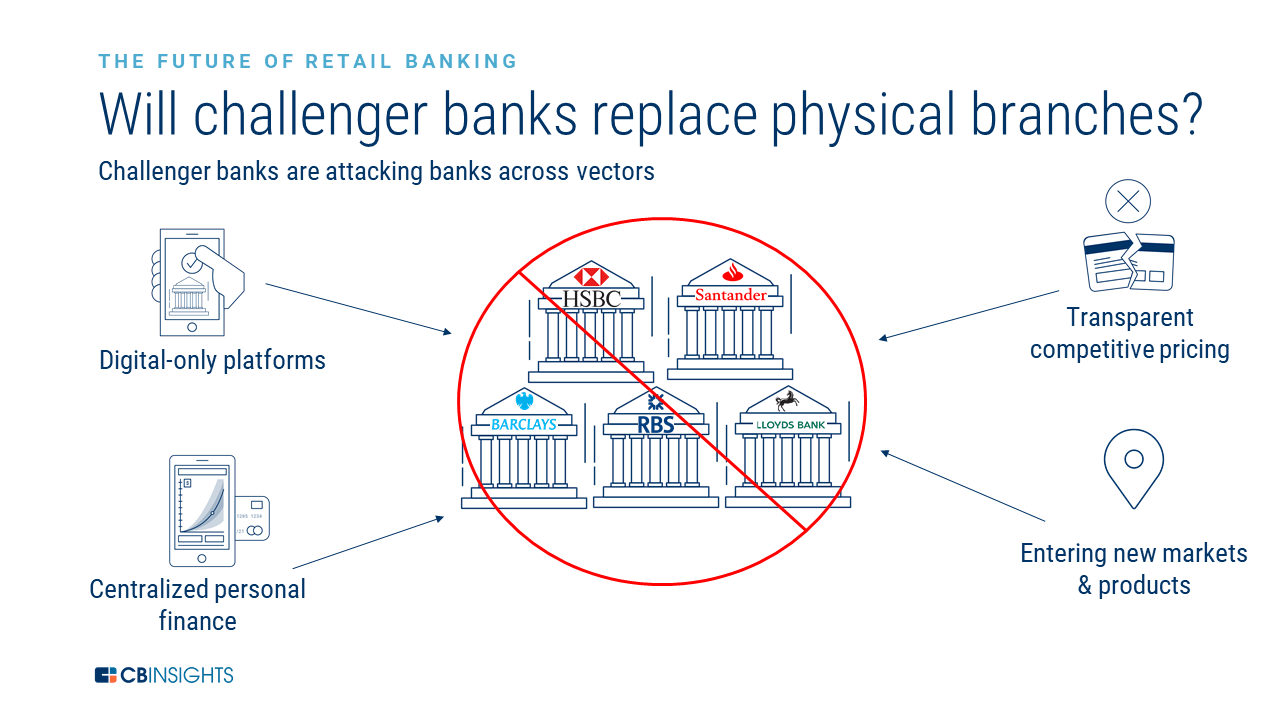

Challenger banks like Monzo and Starling Bank operate by leveraging technology to offer a range of banking services primarily through mobile apps. Here are some key points about their operations:

-

Digital-First Approach: These banks operate without physical branches, providing services through user-friendly smartphone apps. This reduces operational costs and allows for quicker service upgrades.

-

Regulatory Environment: They have benefited from progressive regulatory changes in the EU and UK, which have made it easier to obtain financial licenses post the 2008 financial crisis (CB Insights).

-

Innovation and Features: Challenger banks often offer innovative features such as real-time spending notifications, budgeting tools, and fee-free international money transfers. This positions them as more flexible and responsive compared to traditional banks.

-

User-Centric Design: These banks focus heavily on customer experience, offering intuitive interfaces and fast customer support (Which?).

-

Competition: They are considered smaller players competing with established traditional banks but are rapidly growing due to their attractive offerings and ability to adapt quickly to market demands (NerdWallet UK).

Overall, Monzo and Starling Bank exemplify a new wave of banking that emphasizes digital, agile, and customer-focused services.

Follow Up

Related

What are the main differences between challenger banks and traditional banks?

For this privately held financial services company, a compelling journey of business transformation

For this privately held financial services company, a compelling journey of business transformation

Which banks are significant in Northern Ireland's economy?